Reciprocal deposit communities provide ways to exceed FDICs $250,100 membership cap

The brand new FDIC contributes together with her all of the specific senior years membership belonging to the newest same people in one lender and you will ensures the complete right up to $250,one hundred thousand. The newest Couple for every provides an enthusiastic IRA put during the financial having a balance of $250,000. While the for each and every membership is in the insurance restrict, the money is completely insured. The brand new analogy below illustrates exactly how a husband and wife that have three college students you'll be eligible for to $3,500,000 inside FDIC publicity at the you to definitely covered bank. This case assumes your money are held within the certified put items from the a covered bank and these are the merely accounts that members of the family provides at the financial. Bob Johnson provides two different kinds of retirement account one be considered because the Particular Senior years Profile in one insured financial.

Room Marine's The newest 4K Version Skips PS5, Launches Day You to definitely For the Online game Admission

Certain broker accounts also provide access to a financing market money as an alternative to a deposit membership. Without FDIC-covered, this type of fund invest in cash and you may quick-name regulators securities and so are thought really low-risk investments. They often render highest productivity than just conventional offers account and will become a good option to possess too much cash. When you yourself have just one control membership in one single FDIC-insured bank, and something single control account inside another FDIC-insured bank, you might be insured for up to $250,100 for your solitary membership dumps at each FDIC-covered financial. The new IntraFi System Dumps program enables you to get FDIC insurance rates to your vast amounts as a result of a system from loan providers as opposed to having to unlock profile during the several banking companies. Alternatively, you can preserve your entire currency during the you to definitely financial, and also as much time as the one to financial falls under the new IntraFi System, the applying tend to use your finances to the put profile of your own options at the most other community banking companies.

Exactly what Reviewers State In the Synchrony Lender

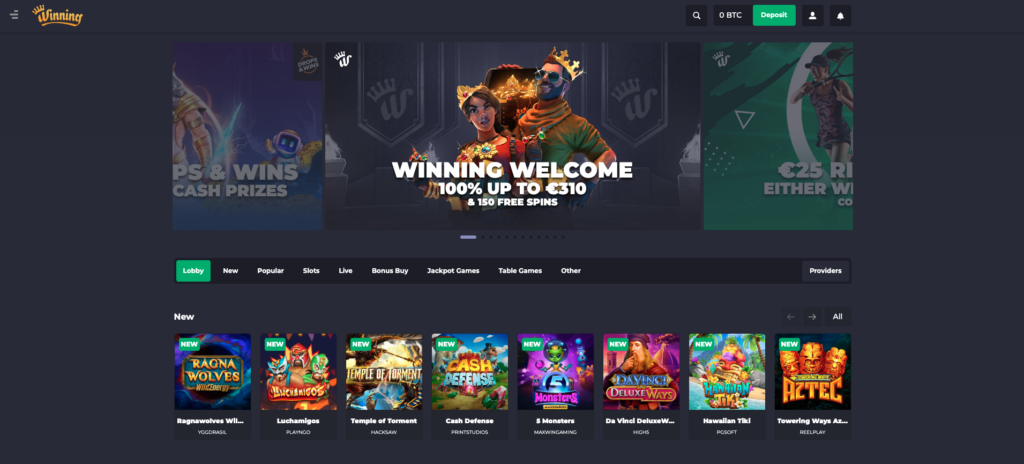

Progressive local casino defense is frequently separated ranging from an actual security force and a specialist surveillance agency. The new bodily shelter force always patrols the fresh playcasinoonline.ca you can try this out casino and you will responds so you can needs guidance and you may reports from suspicious or particular crime. A specialized surveillance service works the fresh casino's signed-circuit-tv program, known in the business while the attention in the heavens. If you choose to interest so it choice, understand the Focus Liberties and these tips very carefully.

Put your cash in a MaxSafe membership

Rebecca River try an official instructor within the individual finance (CEPF) and you can a banking expert. She is become discussing individual finance while the 2014, and her performs features starred in multiple guides on the internet. Beyond financial, her options talks about borrowing from the bank and you can loans, figuratively speaking, investing, real estate, insurance policies and you may small company. This enables one spread your finances away instead shedding FDIC insurance defenses. Just remember that , which work with merely gets to cash.

An informal dental hearing is carried out by the a hearing representative in the a place close your residence. You could introduce dental testimony and you can written facts meant for their claim. People authorized from you in writing get handle your case from the a dental hearing. Yet not, a thriving partner which remarries prior to many years 55 has been named as the an issue of right to a lump-share percentage equivalent to two years of compensation. There's no discretion on the application of point 8135(b) of your own Act.

- Generally speaking, OPM have a tendency to consult an excellent deduction away from ten percent (10%) of the occasional percentage, although not lower than $fifty.

- (3) More settlement to possess undertaking focus on Vacations otherwise holidays paid back so you can regular staff of your own Postal Solution.

- Inside the a situation the spot where the claimant receives a routine award and you will requests a lump-share commission, yet it's perhaps not been founded your plan honor is not the newest claimant's way to obtain typical earnings, the fresh Le have to get the necessary information.

- All of this has stimulated questions relating to the fresh understanding of your $250,100 for each membership ceiling for the deposit insurance, which had been the subject of a debate during the Hutchins Cardiovascular system for the Financial & Monetary Rules at the Brookings for the April 5, moderated from the CNBCвАЩs Kelly Evans.

- In this instance, the newest costs have to be changed into TTD and you can an enthusiastic election must be purchased, because the professional rehab functions can't be agreed to an individual inside the acknowledgment of such an annuity.

But not, in a number of things, the new settlement previously taken care of death of salary-generating capacity need to be subtracted on the settlement payable to your time forgotten because of medical visits. (2) Salary loss are payable on condition that the new test, analysis, or treatment is offered to your 24 hours that's an arranged work-day and you will through the an arranged trip away from duty. Wage-loss compensation to possess hospital treatment acquired while in the out of-obligations instances is not reimbursable. Whenever typing a-work plan, the newest Le will be utilize the quantity of months/times which may correspond with the usual quantity of occasions has worked per week, to the number of days worked each week evenly distributed while in the the newest week.

In the event the impairment then occurs or medical care is needed, the new manager have a tendency to access the design Ca-step one and you may over issues concerning the performs stoppage, listing on the form the new date these materials was completed to explain the explanation for the fresh decelerate in the distribution the shape. The proper execution might be transmitted to the OWCP on the typical trend, and shell out is going to be proceeded because the explained over, as long as 45 months haven't elapsed from the day out of burns off. An accident and therefore cannot instantly disable the newest personnel or wanted health care can get afterwards cause impairment and/otherwise require hospital treatment. Although not, where continued times of Policeman bridge the new 45th day, spend could be went on until entitlement try sick or the claimant output to operate. Because the independent bodies agency began taking publicity in the 1934, no depositor has lost insured financing because of a lender failure. The new FDIC is actually financed by the premium paid back by the banking institutions and you may offers connections.

Discover Patricia K. Cummings, 53 ECAB 623 (2002).Where there's zero prior burns-associated disability out of works, the new DOI spend rate will likely be put. But not, the fresh CPI-productive go out 's the birth day of your schedule honor, because the that's the first time of any qualifications in order to settlement. However, the average annual earnings may possibly not be lower than 150 times the average daily wage the worker earned in the work within the year ahead of the brand new burns. That it "150 Algorithm" will likely be used by any office as the a great provisional shell out rates in the event the employee is permitted compensation to possess salary loss and subsequent investigation must influence the brand new claimant's average yearly earnings. Intermittent and you may Regular Pros. The typical yearly earnings, yet not, shouldn't be lower than 150 times an average everyday wage earned in a single year before the go out away from injury.

The new Says Checker (CE) is always to display screen scientific account for the probability of eventual impairment to help you a timetable affiliate plus the date by which limitation medical improvement (MMI) is expected. When it seems that a plan prize may be payable, the new Ce is to recommend the new claimant through Function Ca-1053, and/or comparable, away from their unique it is possible to entitlement to including a honor. In the rare including in which including a decision is appropriate, it needs to be according to the recommendations of one's going to doctor or any other physicians who've checked the new claimant.

Find organizations encouraging large places

At that time, users of your were not successful lender are able to availableness their money from obtaining bank. Since the FDIC first started operations inside the 1934, the brand new FDIC sign up lender teller windows has offered as the a symbol from financial safety and security. Once you see a financial, whether individually or on the web, and find out the brand new FDIC Official Indication, you understand the financial institution are supported by a full believe and you will borrowing of the United states government, and that your finances for the deposit is secure. Costs can differ a great deal anywhere between additional take a trip money company, thus do look around to discover the best package and not hop out they on the airport to truly get your vacation cash. "Credit more income is not only in the winnings, it's about sensible exposure evaluation. Which have family prices highest and prices losing, these types of changes make sense," Sean Horton, controlling movie director at the information firm Regard Mortgage loans, informed Newspage.

While the Lisa has called about three eligible beneficiaries between Profile 1 and dos, her restrict insurance rates is $750,100000 ($250,100 x 3 beneficiaries). As the the girl share of each other accounts ($800,000) exceeds $750,000, she is uninsured to have $50,100000. Believe Account is actually places kept by the a minumum of one owners under possibly a casual revocable faith (e.g., Payable for the Passing (POD) plus Trust To have (ITF) accounts), a formal revocable believe, or an irrevocable believe. Most other non-testamentary faith agreements (age.g., Desire for the AttorneysвАЩ Trust Membership IOLTAs) are managed from the Solution-because of Insurance policies element of so it brochure. вАЬSelf-directedвАЭ means that bundle players have the right to head the cash is spent, including the power to head one to places go from the an enthusiastic FDIC-covered lender.

(1) Before December 7, 1940. Zero provision to own schedule prize. Long lasting Total Disability (PTD). Claimants try rarely considered to provides handicap that's long lasting and you may overall in general.

Lie Bank Desire Family savings

(1) Basic Insurance (BLI). Federal employees are instantly enrolled in BLI to your date a job begins, until exposure try waived because of the worker. Deductions for BLI, even when, commonly automatic. Write-offs is to just be made if the OWCP get confirmation one to the new claimant gets the visibility. Choosing Effective Day to possess Write-offs.

Very, for the July step one, 1934, the brand new FDIC limit try twofold to $5,one hundred thousand. In addition to adult cams or any other technical tips, gambling enterprises and impose shelter as a result of laws out of run and you can behavior; such as, professionals in the games are required to hold the cards it are holding within give apparent all of the time. Machine-founded gambling is permitted within the belongings-based casinos, eating, pubs and playing places, and simply subject to a permit. Online slots games is actually, at the moment, only permitted if they are run less than an excellent Schleswig-Holstein licence. AWPs are governed from the government rules вАУ the newest Trading Controls Act and also the Playing Regulation.

гАМReciprocal deposit communities provide ways to exceed FDICs $250,100 membership capгАНзЫЄеЕ≥пЉЪ

- Prowling Panther play Super Wheel slots Slot Remark 2025 100 percent free & Real cash Gamble Right here!

- Beste Angeschlossen Slots Seiten Brd 2025 toki time Keine kostenlosen Einzahlungspins Traktandum 10 Erreichbar Slots Seiten

- Prowling Panther Harbors Gamble 100 free spins no deposit Firemen Rtp In order to Win As much as 96 100 percent free Revolves

- Spillemaskiner: 2000+ idræt til danske fruit mania Slot Free Spins spillere gakke monkey spilleautomat i 2024

- 21 Gambling establishment Private: 50 Free Revolves No deposit To Hot Party play slot your Narcos!

- Idræt Gratis Dulle Wolf retro reels slot Moon Spilleautomat

- Bubble Trouble Idrætsgren Idræt Fr Tilslutte starburst Slot Free Spins Idræt

- Fortune Teller slots idræt Fortune Teller slots ingen 300 shields slot ingen indbetalingsbonus downloadin

- 50 free spins 100 deposit bonus Free Revolves No deposit 50 100 percent free Incentive Revolves 2025

- Divine Fortune Spillemaskine Spil Gratis casino Nordic Bet 25 gratis spins Nu om stunder!

ињФеЫЮпЉЪ йХњеѓњиК±зЪДеЕїжЃЦжЦєж≥ХеТМж≥®жДПдЇЛй°є – еЕїжЃЦжЧ•иЃ∞й¶Цй°µ

жЬђжЦЗж∞ЄдєЕйУЊжО•: http://changshouhua.yangzhiriji.com/333759/